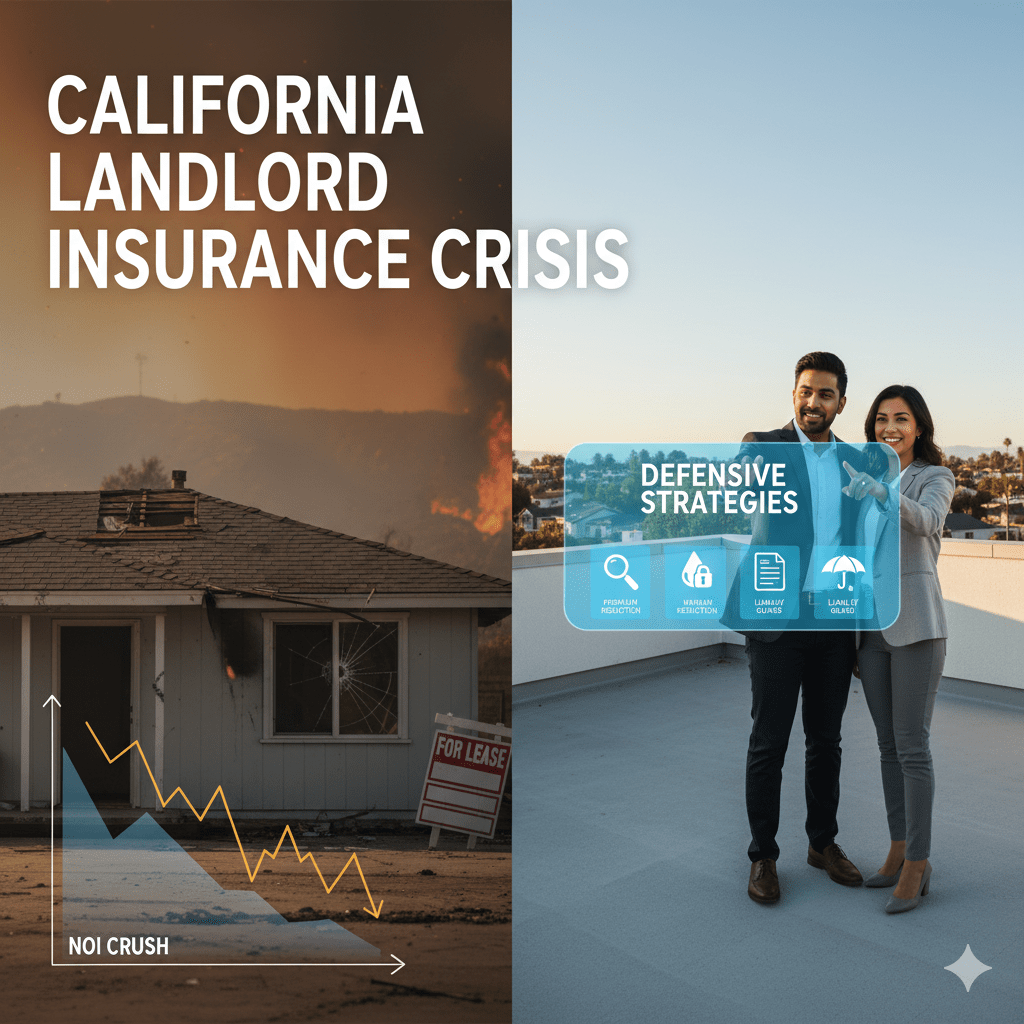

The financial landscape for California landlords has fundamentally changed. In fact, major insurers have pulled back from the state. This happened due to climate risk (wildfires, floods) and strict regulatory environments. Consequently, this exodus led to skyrocketing premiums and increased reliance on the costly FAIR Plan for gap coverage.

Therefore, soaring insurance costs directly erode the Net Operating Income (NOI) for rental property owners. Thus, these costs threaten investment viability. In 2025, annual landlord premiums in high-risk areas often range from $3,000 to $5,000+, demanding immediate action.

Ultimately, this article outlines five critical defensive strategies. These steps secure adequate coverage and fight back against the insurance crisis to protect your portfolio’s profitability.

1. Master the Gap: Understand Replacement Cost vs. ACV

Many landlords attempt to save money. They opt for Actual Cash Value (ACV) policies. However, this is a crucial mistake that exposes the entire investment.

- Replacement Cost (RC): This pays the cost to rebuild the property. Furthermore, it uses modern materials and current labor rates, without deducting for depreciation. This is the only acceptable standard for investment properties.

- Actual Cash Value (ACV): This deducts depreciation (wear and tear) from the replacement cost. For instance, if your 15-year-old roof is destroyed, you might only receive 50% of the replacement cost. Consequently, this leaves you to pay the difference.

Action: Review your policy immediately. Therefore, ensure your dwelling coverage limits reflect the full replacement cost of the structure, not just the market value.

2. Become a Proactive Risk Mitigator

Insurers in California are increasingly using forward-looking catastrophe models to set rates. Thus, they are moving away from historical data. Therefore, physical risk reduction measures translate directly into better insurability and lower premiums.

- Fire Safety Upgrades: For properties in fire-risk areas, installing fire-resistant roofing is non-negotiable. Also, maintain a strict defensible space (clearing vegetation, especially within 30 feet of the structure). In addition, new state grants (like those via AB 888) may help low- and middle-income homeowners pay for these expensive mitigation measures.

- Water Damage Defense: Water damage is the most common claim. Consequently, upgrade aging plumbing systems (like polybutylene or galvanized pipes) during unit turnovers. Installing water leak detection systems can qualify you for premium discounts.

- Security Features: Install centrally monitored burglar and fire alarms. Furthermore, these can generate immediate discounts of up to 25% with some carriers.

3. Leverage Independent Brokers and Bundling Power

The days of relying on a single major carrier are over. Therefore, finding comprehensive coverage now requires specialized knowledge and broad market access.

- Use an Independent Broker: Work exclusively with an independent broker. Ideally, this broker specializes in residential rental properties. Independent brokers represent multiple carriers, including specialized surplus lines (E&S) carriers. In short, this gives you the widest range of quotes and coverage options.

- Bundle Policies: Consolidate your landlord policies (dwelling, liability, etc.) with a single carrier, if possible. Most companies offer substantial multi-policy discounts (often 5%–30%). Moreover, these discounts apply when you bundle multiple properties or combine your personal auto and umbrella policies.

- Increase the Deductible: If you have adequate cash reserves (e.g., $5,000 or more), raising your deductible from $1,000 to $5,000 can drastically reduce your annual premium. In fact, this move potentially saves you up to 25% on the policy cost.

4. Require Tenant Liability & Loss of Income Coverage

Transferring liability risk to the tenant is crucial. Furthermore, securing your own cash flow forms essential layers of defense.

- Mandate Renter’s Insurance: Make renter’s insurance a mandatory term of the lease. This ensures that the tenant’s negligence (e.g., leaving the bathtub running, causing a small fire) is covered by their liability policy, not yours. Ultimately, this helps you avoid filing claims on your policy, which is the key driver of future rate hikes.

- Secure Loss of Rent Coverage: Ensure your landlord policy includes adequate Loss of Rental Income coverage (also known as Fair Rental Value). Therefore, if a fire or covered peril makes the unit uninhabitable, this coverage replaces your lost rent. Thus, it protects your cash flow and mortgage obligations during rebuilding.

5. Protect Against Liability Claims with Umbrella Insurance

Landlord liability risks are significant. Indeed, this is especially true in California’s tenant-friendly environment. Large liability lawsuits (“nuclear verdicts”) are driving up rates for all commercial properties.

- Get Umbrella Coverage: Purchase a separate Umbrella Liability policy for $1 million to $5 million in coverage. This policy kicks in after your standard landlord liability limits are exhausted. Consequently, it is one of the most cost-effective ways to protect your personal assets (your primary home, savings) from a catastrophic tenant lawsuit stemming from injury on the property.

Key Focus: Ultimately, the high cost of insurance in California is the new baseline. Success in 2026 demands a complete shift. This means actively managing and mitigating the risk, thereby converting your insurance expense from a passive cost to an active strategic defense.

Kurt Galitski- Principal, Broker

(949) 688 7705 | DRE #: 01348644

2919 Newport Blvd, Newport Beach, CA 92663

DISCLAIMER: This article is for informational and educational purposes only and is based on publicly available data from official state and county sources. We are NOT tax professionals, insurance professionals, financial advisors, CPAs, or attorneys. The information provided does not constitute legal, insurance, tax, or financial advice.