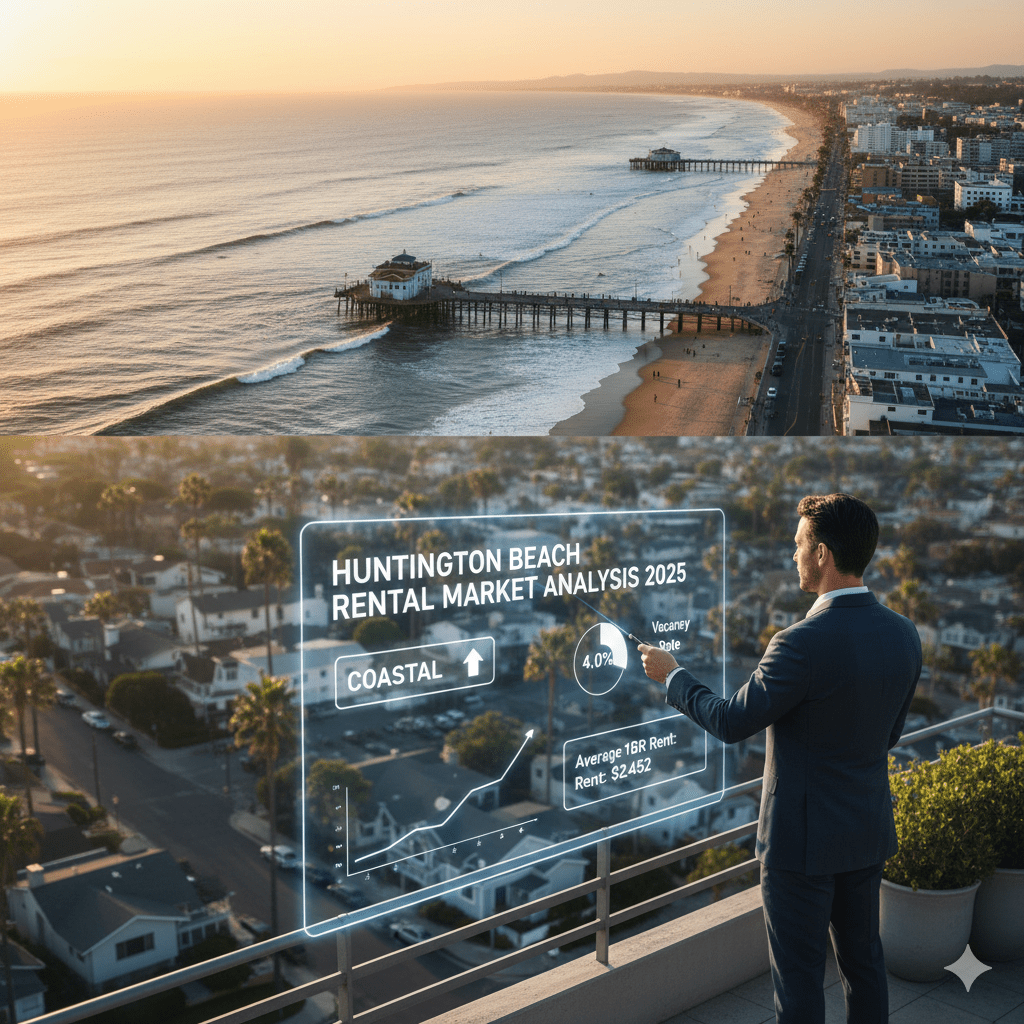

Executive Summary

Huntington Beach offers investors a compelling balance: coastal demand and a slightly more accessible entry point compared to its neighbors. Stability currently defines the rental market as of November 2025. While apartment rent growth moderated to single digits (around +1.2% YoY), low vacancy rates preserve a tight market. Consequently, long-term investors find Huntington Beach attractive for achieving moderate cash flow alongside solid appreciation, particularly in non-beachfront single-family housing. Short-Term Rentals (STRs) offer higher potential, but strict local regulations severely limit this segment.

Key Market Metrics and Price Stability

Huntington Beach rents reflect its high desirability without reaching the ultra-premium levels of Newport Beach, creating a broader renter base.

Median Rent (All Property Types, Nov 2025): $3,428

This median is influenced by a diverse housing mix, including high-density apartment complexes and single-family beach houses.

Apartment and Single-Family Averages:

- Average 1BR Apt: $2,452

- Average 2BR Apt: $3,050

- 3BR House Rent: These rents command a significant premium, typically ranging from $5,000 to $6,500+

Rental Trends: Stability now governs the market. While some data shows marginal annual growth (around +1.2% YoY for apartments), other aggregated median data shows rents plateaued or slightly softened (MoM), consistent with seasonal cooling after the high summer demand.

Supply, Vacancy, and Investment Yield

Market dynamics in Huntington Beach favor sustained occupancy and predictable income.

Vacancy Rate: Orange County maintains an extremely low vacancy rate of 3.6% – 4.0%. Due to strong local demand (lifestyle, schools, tourism) and limited new construction, Huntington Beach typically enjoys similarly tight occupancy, ensuring reliable revenue streams for owners.

Cap Rate Potential: Huntington Beach offers better relative cash flow than Newport or Irvine because median home prices, while high $1.3M, are lower. Cap Rates, while still challenging, are generally more viable for investors targeting long-term rental income. A local expert often seeks assets capable of achieving a 5% Cap Rate for long-term holds.

STR Regulation: The city strictly regulates Short-Term Rentals. This regulation decreases the available inventory of high-yield vacation rentals, yet paradoxically stabilizes the long-term rental market and reduces competition for traditional landlords. Investors must ensure full compliance and proper permits before pursuing this lucrative niche.

Strategic Investor Focus for Coastal Cash Flow

Investors should tailor their strategy to maximize both the coastal lifestyle appeal and steady cash flow potential:

1. Target the Inland SFH (Single Family Home) Niche: Concentrate investment in stable, family-friendly areas like South Huntington Beach or properties near Goldenwest/College Park. These areas attract long-term, high-quality tenants drawn by the school districts, offering optimal stability and lower turnover.

2. Focus on Value-Add Upgrades: Since coastal tenants expect quality, invest capital wisely. Upgrades that justify rent bumps (e.g., in-unit laundry, modern kitchens, dedicated parking) immediately boost rental value.

3. Leverage the Lifestyle Premium: Position marketing to highlight the “Surf City” lifestyle, even for properties a few miles inland. This leverage justifies the high rent premiums and attracts renters who prioritize the coastal culture.

Question for the network: With Cap Rates tight across OC, does Huntington Beach’s balance of coastal demand and lower entry price compared to Newport Beach make it the best long-term buy-and-hold option right now?

Kurt Galitski- Principal, Broker

(949) 688 7705 | DRE #: 01348644

2919 Newport Blvd, Newport Beach, CA 92663

DISCLAIMER: This article is for informational and educational purposes only and is based on publicly available data from official state and county sources. We are NOT tax professionals, financial advisors, CPAs, or attorneys. The information provided does not constitute legal, tax, or financial advice.