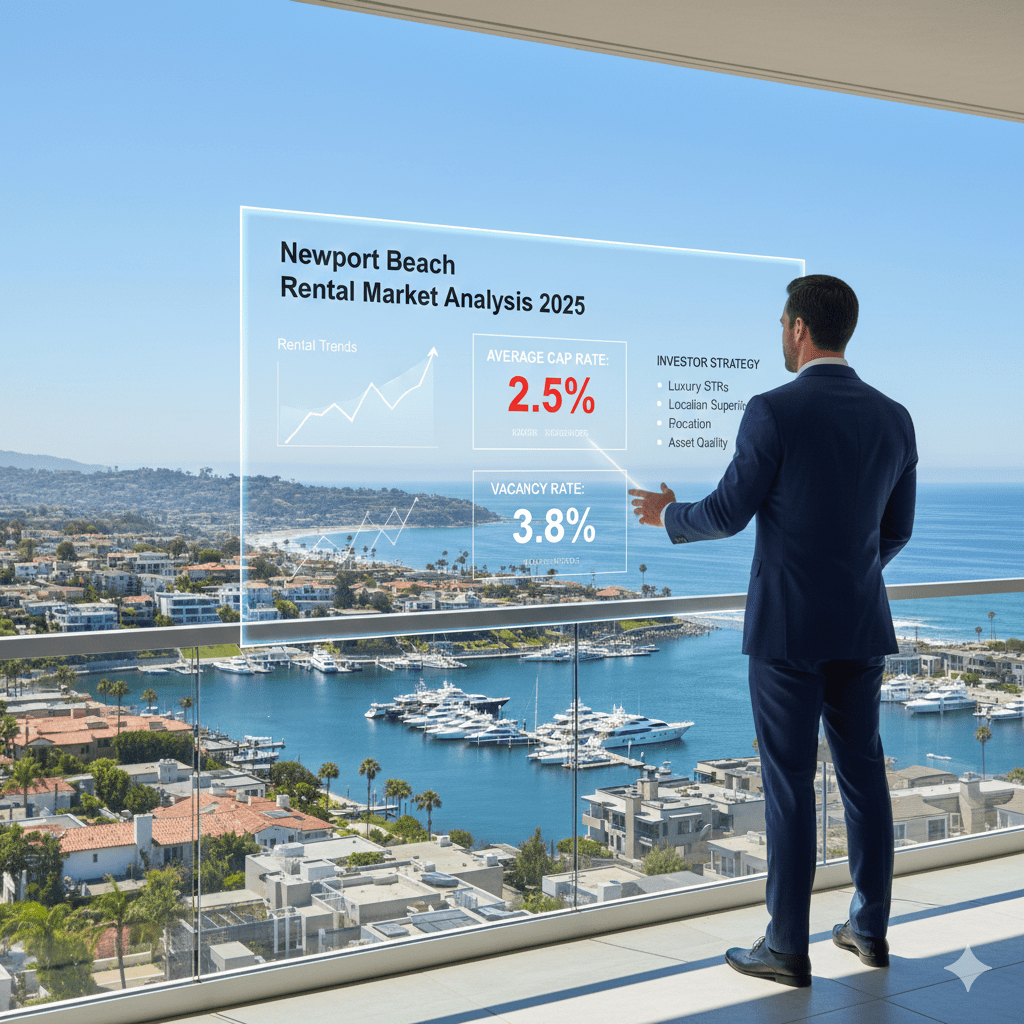

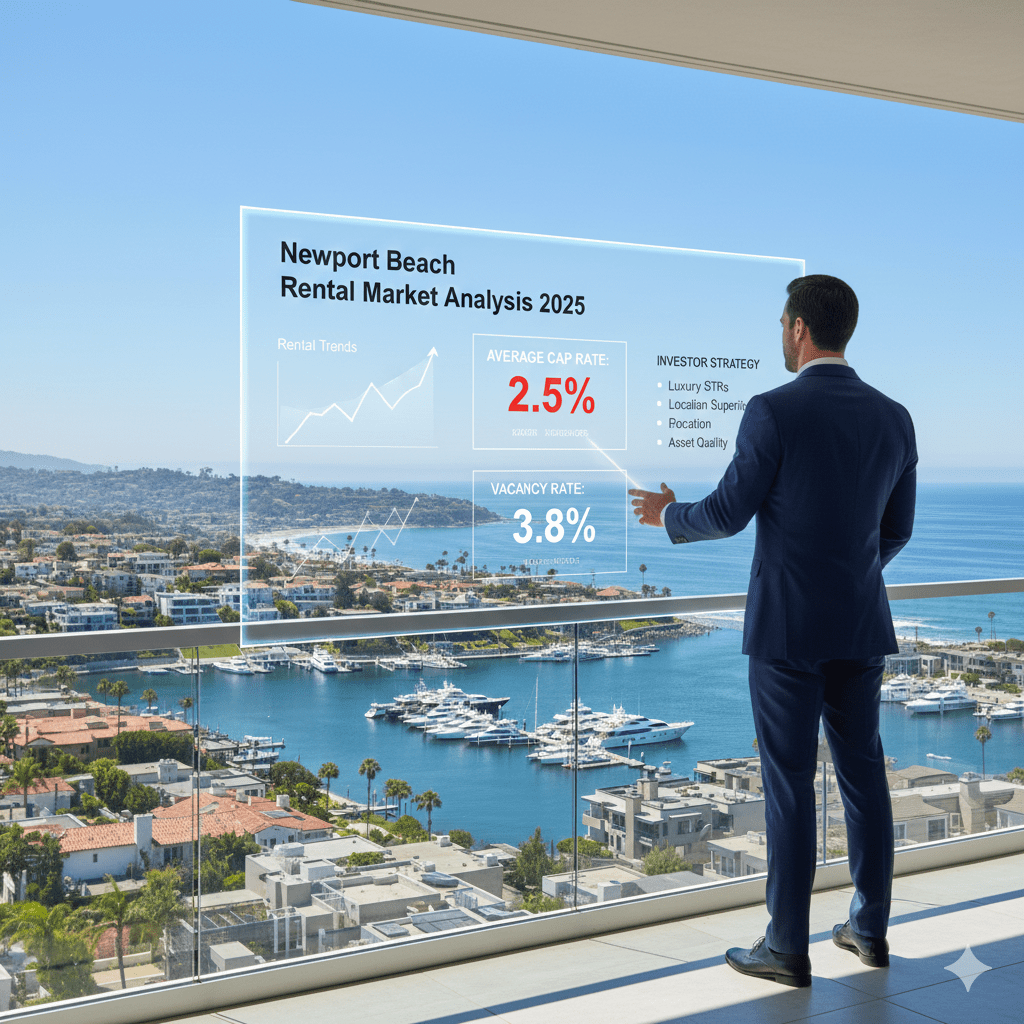

Executive Summary

Newport Beach maintains its position in an exclusive luxury sphere. Extreme price polarization, ultra-low vacancy, and fierce competition for coastal assets define the rental market as of November 2025. The investment model here heavily relies on long-term capital appreciation, because stratospheric purchase prices significantly compress immediate cash flow yields. Specifically, the Short-Term Rental (STR) sector currently offers the most lucrative opportunities, but this strategy involves higher regulatory risk.

Key Market Metrics and Price Duality

Investors cannot assess Newport Beach using typical apartment averages. Consequently, the market splits clearly between standard multifamily units and high-end coastal homes.

Median Rent (All Property Types, Nov 2025): $8,500 (E) This median directly reflects the overwhelming presence and high value of single-family homes, luxury condos, and waterfront properties.

Multifamily Apartment Averages:

- Average 1BR Apt: $3,196 (Reflects non-coastal or older stock)

- Average 2BR Apt: $4,031

- Luxury House Rent: These rents often exceed $12,000 to $30,000 + for waterfront or new-build estates.

Rental Trends: The market shows stable, strong growth. Apartment rent increases tracked around +5.7% YoY earlier in 2025. Clearly, this high-end momentum outperforms other Orange County submarkets.

Supply, Demand, and Investment Yield

Crucially, market fundamentals mandate that demand will continue to far outstrip new supply, thereby keeping unit availability exceptionally tight.

Vacancy Rate: Orange County’s overall vacancy rate holds at a compressed 3.6% – 4.0%. Therefore, Newport Beach—especially enclaves like Corona del Mar and Balboa Island—is effectively vacancy-proof for well-managed, quality assets.

Cap Rate Reality: Since median home prices hover around $3.5 million and above, high purchase costs heavily compress Cap Rates for traditional long-term rentals, often driving them below 3.0%. Ultimately, investors primarily derive the return on investment from tax-advantaged appreciation and wealth preservation.

The STR Opportunity: Short-Term Rentals (STRs) in areas with favorable zoning (Balboa Peninsula) deliver significantly higher income potential. However, this strategy carries higher operating costs and exposure to municipal regulation risks.

Strategic Investor Focus for Coastal Assets

For investors entering or repositioning within Newport Beach, focus your approach on quality and niche markets:

1. Go Niche with Luxury STRs. If maximizing yield is your goal, aggressively pursue properties in zones permitting short-term rentals. Furthermore, ensure the asset features luxury amenities to capture premium nightly rates.

2. Focus on Location Superiority. For long-term holds, target assets in locations with irreplaceable scarcity, such as Balboa Island or Corona del Mar (for village walkability). These micro-markets offer the strongest hedge against future market shifts.

3. Asset Quality is Non-Negotiable. Given the high price of entry, tenants and buyers expect turnkey condition. Consequently, investing in older assets demands a substantial budget for professional, high-end renovations to justify the rental premium.

Question for the network: For investors already holding high-value Newport Beach property, are you shifting any long-term leases to the potentially higher-yield STR market this winter, or are the regulatory and operational risks still too high?

Kurt Galitski- Principal, Broker

(949) 688 7705 | DRE #: 01348644

2919 Newport Blvd, Newport Beach, CA 92663

DISCLAIMER: This article is for informational and educational purposes only and is based on publicly available data from official state and county sources. We are NOT tax professionals, financial advisors, CPAs, or attorneys. The information provided does not constitute legal, tax, or financial advice.