If you rent, or plan to rent, in California, listen up! New laws taking effect in 2024 and 2025 are completely changing the rules around security deposits, cleaning fees, and how landlords charge for damages. The goal? To stop unfair deductions and make renting more transparent and affordable for everyone.

This isn’t just about technicalities—it’s about protecting your money and giving you more control over your move-out costs.

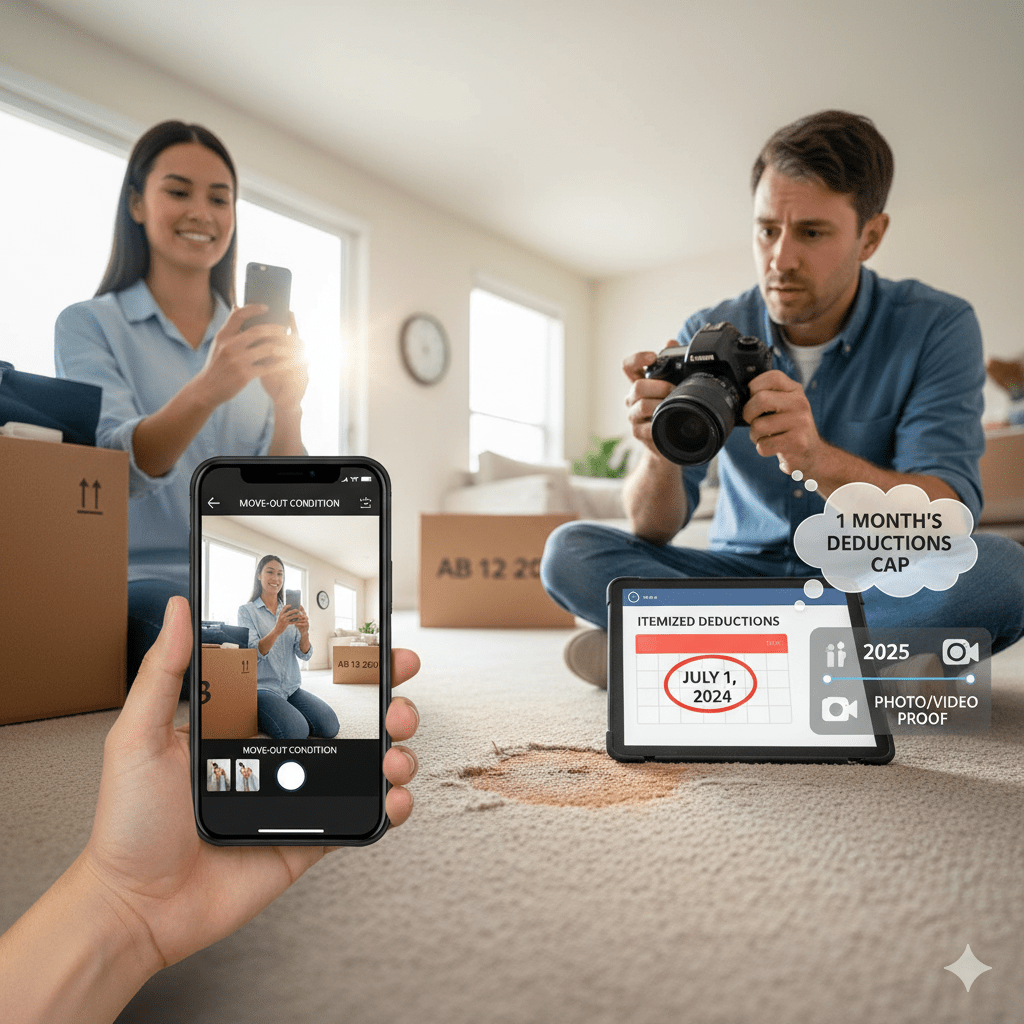

Security Deposit Caps are Dropping (Effective July 1, 2024)

The biggest immediate change is how much a landlord can legally ask for upfront. Assembly Bill 12 (AB 12) slashes the maximum security deposit for most people.

- The New Standard: The security deposit is now capped at one month’s rent, whether your unit is furnished or unfurnished.

- The Old Rule: Previously, landlords could charge up to two months’ rent for an unfurnished unit and three months’ rent for a furnished unit.

- Pet Deposits: Say goodbye to extra pet deposits! They must now be included within that new one-month rent cap.

Good to Know: This new, lower cap applies to all new leases signed on or after July 1, 2024. If you’re a military service member, the one-month cap applies to you regardless of the landlord’s size.

Small Landlord Exception: If a landlord is a natural person and owns no more than two properties with four or fewer units total, they may still charge up to two months’ rent.

Mandatory Photo and Video Proof (Phased in 2025)

Ever felt like you were charged for damage you didn’t cause? Assembly Bill 2801 (AB 2801) introduces new documentation requirements to put an end to arbitrary deductions. This means your landlord now needs a camera, not just a list, to prove any claims.

- Move-Out Proof (Effective April 1, 2025): If a landlord keeps any money for damage or cleaning, they must provide photo or video evidence of the unit’s condition after you move out, but before any work is done.

- Move-In Proof (Effective July 1, 2025): For new leases, landlords must take photos or videos of the unit at the time of move-in to document its starting condition.

- Before-and-After: If a repair deduction is made, the landlord needs to show “before-and-after” photos of the affected area.

Bottom Line: No photos or video? No deduction! This dramatically increases transparency and makes it harder for landlords to claim damage without clear evidence.

Strict Rules on Cleaning and Damages (Effective 2025)

AB 2801 also cracks down on automatic charges and ensures fairness when assessing damage.

- No Automatic Cleaning Fees: Landlords cannot include a standard, automatic charge for professional cleaning (like for carpets). They can only charge for cleaning that is “reasonably necessary” to restore the unit to its original condition, minus normal wear and tear.

- The “Useful Life” Rule: Landlords must consider the age and expected life of damaged items. They can’t charge you for a brand-new replacement if the item was old and mostly worn out already.

- Example: If a 10-year-old carpet with a 10-year lifespan is damaged after seven years, you are only responsible for the remaining three years of its value, not the full cost of new carpet.

These laws put the burden of proof squarely on the landlord, protecting tenants from footing the bill for normal aging and regular apartment upkeep.

Final Takeaway for Renters

These new California laws are a major win for tenants. They reduce the high upfront cost of moving and add crucial layers of protection against unfair security deposit deductions.

Be aware of these effective dates and know your rights:

- Starting July 1, 2024: Security deposit is capped at one month’s rent (for most).

- Starting April/July 2025: Landlords must use photo evidence to justify deductions.

Kurt Galitski- Principal, Broker

(949) 688 7705 | DRE #: 01348644

2919 Newport Blvd, Newport Beach, CA 92663

DISCLAIMER: This article is for informational and educational purposes only and is based on publicly available data from official state and county sources. We are NOT tax professionals, financial advisors, CPAs, or attorneys. The information provided does not constitute legal, tax, or financial advice.