As a California homeowner, understanding property tax deadlines is not just about fiscal responsibility—it’s about protecting your biggest investment from costly penalties. While many taxes are handled automatically, the moment you buy a new property, a unique and easily missed bill known as the Supplemental Tax can appear, catching even seasoned homeowners off guard.

This guide clarifies the standard payment schedule, details the crucial exception for new buyers, and provides a direct, county-by-county roadmap for finding and paying your property taxes online.

The Standard California Secured Property Tax Schedule

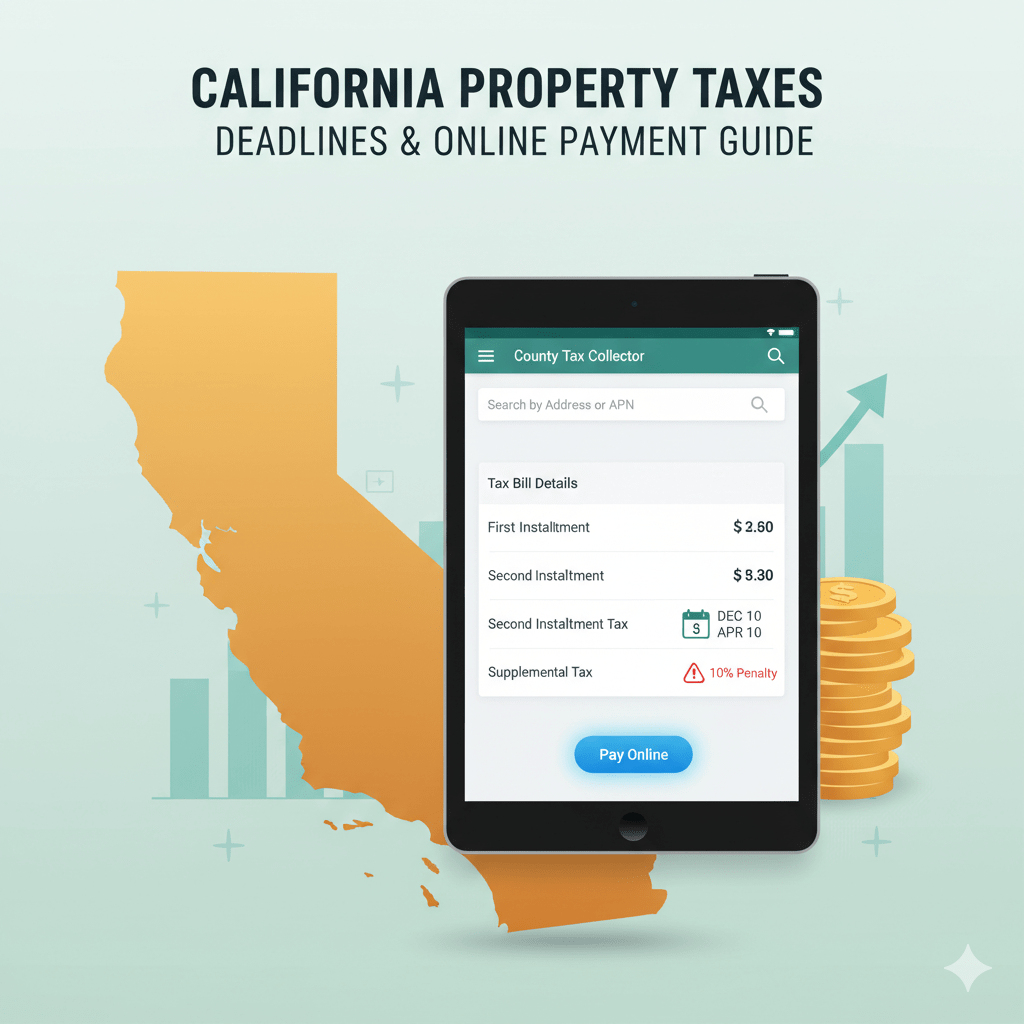

In California, secured property taxes are managed by your local County Tax Collector’s Office and are payable in two installments, adhering to a “first half/second half” schedule:

| Installment | Due Date | Delinquency Date (10% Penalty Applied) |

| First Installment | November 1 | December 10 |

| Second Installment | February 1 | April 10 |

Crucial Deadline Note:

The 10% penalty is applied if your payment is not received or postmarked by the U.S. Postal Service (USPS) on or before 5:00 PM on December 10th and April 10th, respectively.

Escrow vs. Owner: Who is Responsible for Payment?

Whether you have an Escrow Account (also known as an Impound Account) with your mortgage lender or you pay the bill yourself, the county holds the property owner—you—responsible for the timely payment of taxes.

The Escrow Account and the Supplemental Tax Trap

When you have an escrow account, your lender generally handles the two annual secured tax installments. However, when you first purchase a property, you will almost certainly face the issue of Supplemental Property Taxes.

What are Supplemental Taxes?

When a property is sold, it is reassessed at the new purchase price. Supplemental Taxes are a one-time bill covering the difference in tax value between the old assessment and the new one, prorated from the day your escrow closed until the end of the fiscal tax year (June 30).

Why Your Lender Won’t Pay This Bill:

Supplemental Tax Bills are mailed directly to the property owner, not the lender, and often arrive separately from the standard annual bills. Lenders typically do not automatically account for or pay this unpredictable bill from your impound account.

How to Manage Your Supplemental Tax Bill:

- Wait for the Bill: The county will mail you the Supplemental Tax Bill. Its due dates vary based on when it is mailed, so you must read the notice carefully.

- Act Immediately: As the homeowner, you have two options to avoid the penalty:

- Pay it Yourself: Pay the bill directly to the County Tax Collector by the due date.

- Inform Your Lender: Contact your mortgage lender immediately and explicitly inform their Escrow/Impound department about the supplemental bill. You may need to forward them a copy and verify that they will process the payment.

The Penalty: If the Supplemental Tax is not paid by its specific deadline, a 10% penalty will apply.

How to Find Your Property Tax Bill and Pay Online

Every property owner in California can find the exact amount due, verify the payment status, and pay online through their respective County Tax Collector’s website.

Follow this simple, two-step process:

Step 1: Locate Your County’s Tax Collector Website

The most authoritative source for all 58 California county tax offices is maintained by the California State Board of Equalization (BOE):

- Click this Link: California County Tax Collector Contact List

- Find Your County: Locate your county name in the list.

- Find the Link: Look under the “Tax Collector” column and click the name (which is often a hyperlink) to navigate directly to your County Tax Collector’s official website.

Step 2: Search, View, and Pay Your Bill

Once on the County Tax Collector’s website, follow these general steps:

- Look for the Payment Portal: Search for a clear link or button labeled “Pay Property Taxes,” “Search and Pay,” or “Tax Bill Inquiry.”

- Search Your Property: You can typically search using either of the following identifiers:

- Your Address

- The Assessor’s Parcel Number (APN) (found on previous bills or closing documents)

- Pay Online: After locating your bill, you will be able to view the outstanding balance and choose to pay it online. Most counties offer a free e-Check (ACH) option and a credit/debit card option (which may include a small processing fee).

By taking control of this process and understanding the nuances of the Supplemental Tax, you ensure that you meet your legal obligations and avoid unnecessary fees. If you have any trouble finding your bill, the County Tax Collector’s office staff is your best resource for assistance.

Kurt Galitski- Principal, Broker

(949) 688 7705 | DRE #: 01348644

2919 Newport Blvd, Newport Beach, CA 92663

DISCLAIMER: This article is for informational and educational purposes only and is based on publicly available data from official state and county sources. We are NOT tax professionals, financial advisors, CPAs, or attorneys. The information provided does not constitute legal, tax, or financial advice. Always consult with a qualified professional regarding your specific property tax obligations, tax calculations, and supplemental bills.