Myth #1: Go with Your Gut

Most landlords know that using their gut to judge a person is not the wisest decision. According to a 2016 survey done by the TransUnions screening service, SmartMove, 86% of landlords said they verify an applicant’s information before signing a lease. However, there are still thousands of landlords a year that are duped by rental scammers who prey on “gut-feeling” landlords.

The applicant might look perfect on paper, but are they really? No matter how strong your gut feeling is, never assume that an applicant’s self-provided information is accurate. If they claim to make an astronomical amount as a self-employed individual and are offering to pay the year upfront – that should be, at the least, a yellow flag.

While rental applications are designed to collect information about the prospective tenant, that alone is not enough. You need to take caution to protect your property and rental business. Take the time to verify income and employment. If they’re self-employed, they should be able to provide you with their tax returns. If someone shies away from full transparency, move on to the next. You’ll be glad you did.

Myth #2: A High Credit Score = A Great Tenant

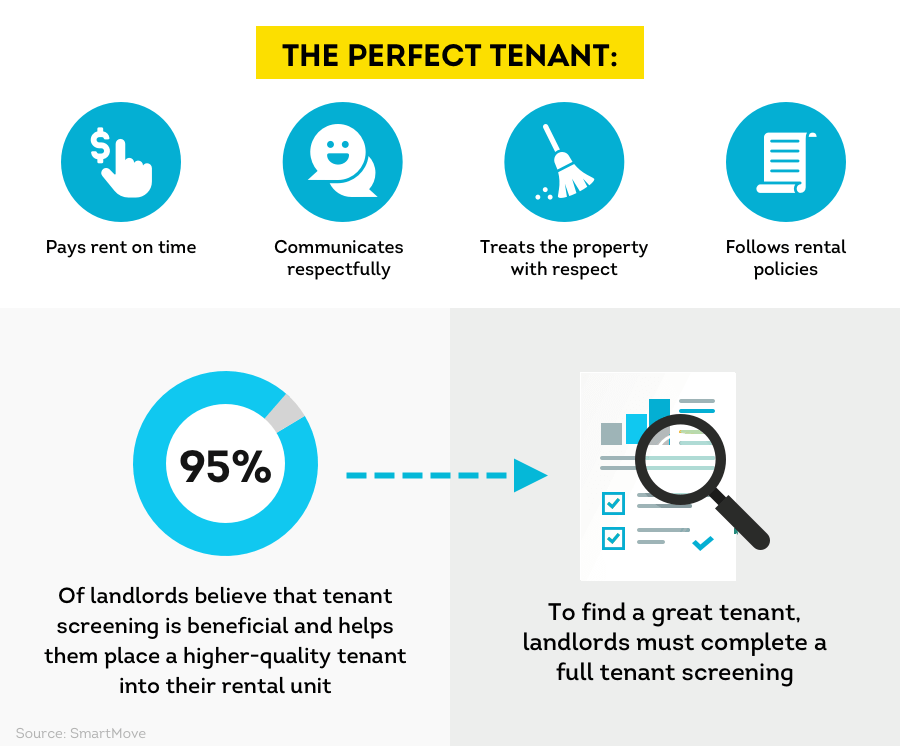

Their number doesn’t tell the whole story. A high credit score doesn’t necessarily mean an applicant will respect your property and, conversely, a bad credit score doesn’t necessarily mean an applicant would be late paying their rent.

Younger applicants—especially Millennials and Gen Z—may have little to no credit history. Furthermore, someone that has recently gone through a divorce or has been battling cancer may have a lower score because of their spouse’s debt or outrageous medical expenses.

There is not a definitive “good